Electric vs. Gasoline Cars: What It Means for the Auto Parts Market

July 28, 2025

According to the Global EV Outlook 2024, by 2035, every second vehicle sold worldwide will be electric. Electric cars in Europe are no longer just a trend — they are quickly becoming the norm. Meanwhile, internal combustion engine (ICE) cars still hold a strong presence in many markets. As a result, demand for auto parts and garage equipment now follows two distinct paths.

This article breaks down how manufacturers and suppliers can navigate this shift, reviews the current state of the sector, and highlights the product segments with the highest demand.

Cars and Related Products: What the Market Looks Like Today

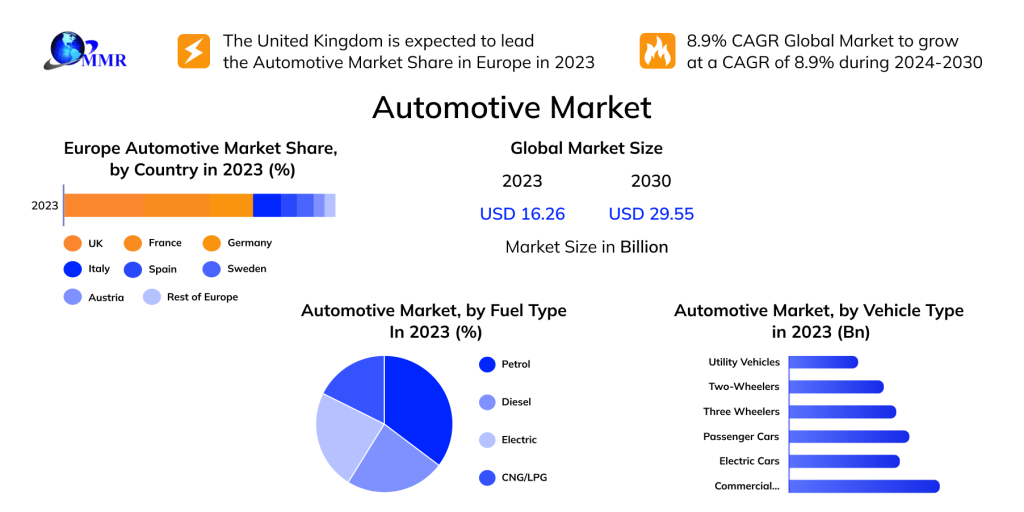

The automotive industry today combines advanced technology with established offerings. In 2023, the European segment was valued at $16.26 billion, according to Maximize Market Research. Forecasts project an average annual growth rate (CAGR) of 8.9% from 2024 to 2030. If this pace continues, the segment could reach $29.55 billion by the end of that period.

In 2023, electric car sales 2025 accounted for 18% of all vehicles sold worldwide, with a significant share coming from Europe. The EU held the second-largest portion of EV sales globally — 25% — just behind China, as outlined in Global EV Outlook 2024.

Despite the growing popularity of electric vehicles, gasoline-powered models still dominate in countries where charging infrastructure is limited, such as Hungary, Romania, and Greece. However, this is likely to change soon as the European Union tightens carbon emissions regulations, accelerating the shift toward cleaner technologies.

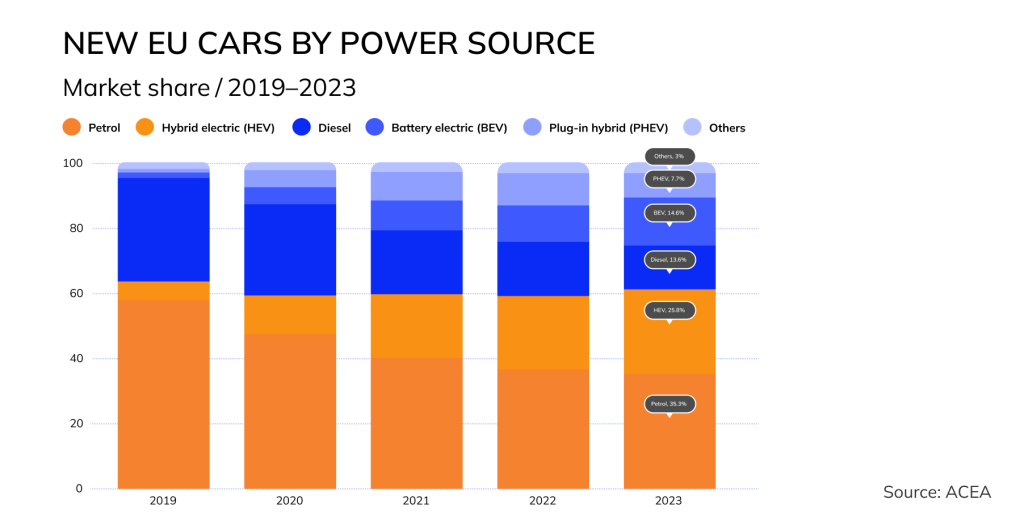

Amid these regulatory changes, hybrid models are also gaining traction. In France, for instance, hybrid car sales increased by 40% in 2023, now representing about a quarter of the national market, based on data from Statista.

This shift is transforming the auto components niche, prompting the dealer supply chains to respond to dual demand. They must continue offering a range of traditional solutions for combustion engine vehicles while also expanding their selection for battery-powered models.

Auto Parts and Service Market in 2025: Key Product Segments

The industry currently navigates two parallel European automotive trends: the rise of electric vehicles alongside a gradual renewal of internal combustion engines. These shifts are creating new demands for service stations and suppliers. Below are the key items expected to be essential for the future of the auto parts industry.

Spare Parts for Internal Combustion Cars

According to the European Automobile Manufacturers’ Association (ACEA), in 2023, gasoline-powered vehicles accounted for 35.3% of new car sales in Europe, while diesel vehicles made up 13.6%. This means that nearly half of all new automobile purchases still rely on ICE.

Car filters sales, engine oil market, belts, and brake pads are expected to remain steady over the next decade.

- It’s important to monitor the specific dynamics of your country-based market. Tracking the balance of EV vs. ICE will help identify which auto parts will see higher demand.

- Stock up on spare parts for older models. As components for cars over 10 years old become harder to find, it’s wise not to phase these items out of your inventory too quickly.

- Prepare for peak seasons. Before winter or summer, it’s wise to keep a stock of thermostats, radiators, gaskets, and starters — these items often fail when temperatures change.

The main recommendation is to study the regional landscape and adjust your product range accordingly.

Equipment for Electric Cars

Electric sales are increasing by at least 20% annually, fueling greater demand for car batteries, high-voltage cables, cooling systems, and chargers. To take advantage of this growth, it’s important to focus on several key factors.

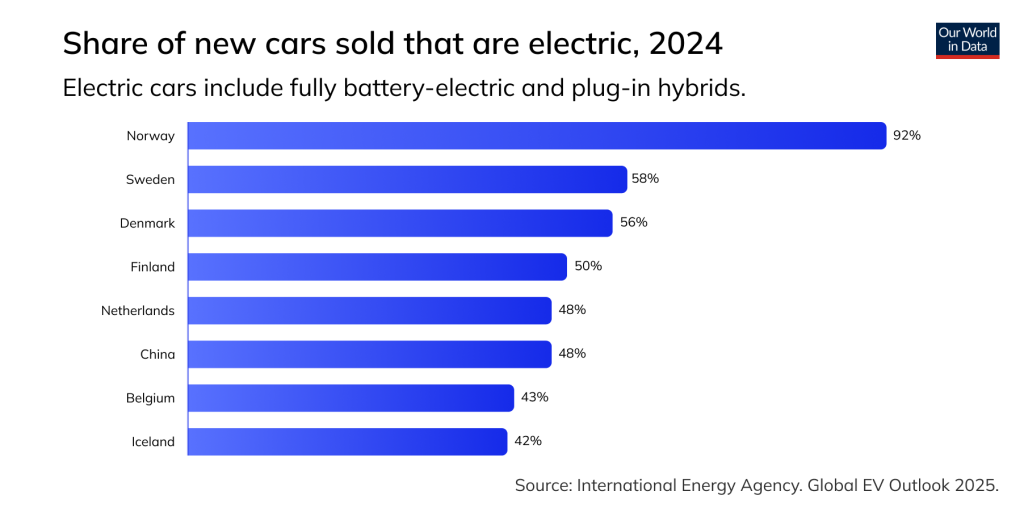

- Consider investing in warehouses close to major EV markets to cut delivery times, a crucial advantage for service providers. In 2024, Norway topped global EV sales, with EV markets in Sweden, Denmark, and Finland also posting strong figures, according to statistics from Our World in Data.

- Monitor updates to the model lineups of major EV parts manufacturers. For instance, the growing range of electric vehicles from Volkswagen, Mercedes-Benz, and Renault is increasing demand for specialized components, including control units and charging cables.

Staying competitive requires keeping up with industry trends and concentrating on the most promising spheres.

Product Range for Hybrid Cars

Service stations servicing both combustion engines and electric systems present significant opportunities. They require high-voltage cables and connectors, cooling fluids for HV batteries, long-life spark plugs, motor oils, brake pads, and other essentials.

To ensure consistent demand, develop recommended maintenance kits for hybrid vehicles. For example, a service kit for the Toyota Prius or Renault Clio E-Tech might include filters, spark plugs, and diagnostic tools designed to match their standard maintenance intervals.

Additionally, provide flexible terms to service stations transitioning to hybrid maintenance. Buyback programs for unused gasoline car goods or joint marketing efforts can support these businesses as they adjust to the evolving offering selection.

Digital Technologies for Diagnostics and Repair

Concluding the Dentos research, demand is growing for high-precision diagnostic scanners, software, and tools compatible with electric vehicles. This trend reflects broader shifts, as artificial intelligence reshapes industries. Today’s customers prioritize speed, quality, and ease of use. To meet these expectations, we suggest:

- Invest in digital diagnostic equipment compatible with electric and hybrid vehicles, such as goods from Bosch Automotive Solutions, Autel, and Launch.

- Support your clients by offering manuals and training materials to help them get acquainted with new tools.

- Partner with software developers to ensure regular updates and enhance functionality.

Updating your lineup isn’t enough — you need a strategy that addresses the real needs of car service centers. Focus on the balance between electric and hybrid vehicles, technological changes, and service providers’ expectations for speed, flexibility, and technical support.

What B2B Clients Expect from Auto Parts Suppliers in 2025

Choosing assortments and managing inventory are only part of a supplier’s role. Nowadays, service centers and other clients place growing importance on competitive pricing, quality service, ongoing support, and opportunities for long-term partnerships. Let’s explore how to build strong, effective collaborations with them.

Optimize Delivery

Both modern end customers and B2B partners value speed. To meet this expectation, flexibility is essential:

- Monitor your inventory closely and restock promptly to handle sudden demand spikes.

- Partner with local warehouses or logistics centers to reduce delivery times.

- Provide an “express delivery” option.

This approach will help you accelerate service and strengthen customer loyalty.

Ensure Quality

Meeting industry standards is vital for gaining B2B clients’ trust. Make sure your products carry all necessary certifications, such as:

- IATF 16949 (formerly ISO/TS 16949) — an automotive standard aimed at reducing defects and ensuring high quality.

- TÜV — certifies safety and compliance with European technical regulations, especially for electronics and complex equipment.

- RoHS and REACH — verify the absence of harmful substances, crucial for electronics, cables, and batteries.

Regular internal and external audits, along with providing official warranty documentation, build confidence and encourage clients to choose your service.

Provide Technical Support

The automotive aftermarket trends are constantly evolving, and service centers often struggle to keep up with new trends. Suppliers who actively help their partners understand new products and technologies gain a clear competitive edge.

Offer prompt technical support through channels like chat, hotlines, or dedicated account managers. Additionally, develop clear, user-friendly guides, training videos, and detailed FAQs to quickly resolve common questions.

How Manufacturers and Suppliers Can Secure a Strong Position in the Market

In today’s vehicle maintenance and service sector — where combustion engine vehicles and electric models share the road — manufacturers and suppliers need a well-defined strategy to stay ahead. Here are a few key steps to help you navigate this evolving landscape with confidence.

- Segment Your Audience. Identify your main client groups — whether they’re large service chains, independent workshops, dealers, or distributors. Clear segmentation allows you to set appropriate minimum order sizes, fine-tune your pricing strategy, and craft targeted marketing campaigns.

- Analyze the Data. Use digital tools to track sales analytics, monitor demand, and adjust your product range accordingly.

- Take Part in Industry Events and Trade Shows. Face-to-face interaction with potential partners builds trust and gives you a chance to highlight what sets your goods apart. Trade shows, forums, and industry conferences are valuable not just for networking but also for identifying new sales opportunities and staying informed about market trends.

- Plan Business Growth With the Future in Mind. Evaluate your local niche while also considering potential export opportunities. Monitor trends in the electric and hybrid vehicle segments so you can adapt your catalogs and logistics in advance, positioning your business for long-term success. For instance, to ensure long-term resilience, businesses should focus on building a sustainable auto supply that integrates eco-friendly materials, efficient logistics, and responsible sourcing practices.

For a strong start, consider selling on marketplaces. Entering the business through established platforms is a cost-effective way to get started — no need for upfront investment in your website or marketing infrastructure. For example, ServiCom, a Scandinavian B2B marketplace, provides built-in tools for promotion and analytics, helping you quickly connect with your target audience.

The automotive product innovations are changing fast. Businesses that actively grow their client base and stay aligned with market trends will have a clear advantage.