E-commerce Online 2026: How the European Market Is Changing

October 15, 2025

The European e-commerce sector enters 2026 with record-breaking sales figures — yet new challenges are emerging alongside this growth. In this article, we explore how the structure of online trade is evolving, which new regulatory frameworks are coming into effect, the latest e-commerce shopping statistics, and how sellers, suppliers, and manufacturers can prepare for the new market landscape.

Cross-border as the Main Growth Driver

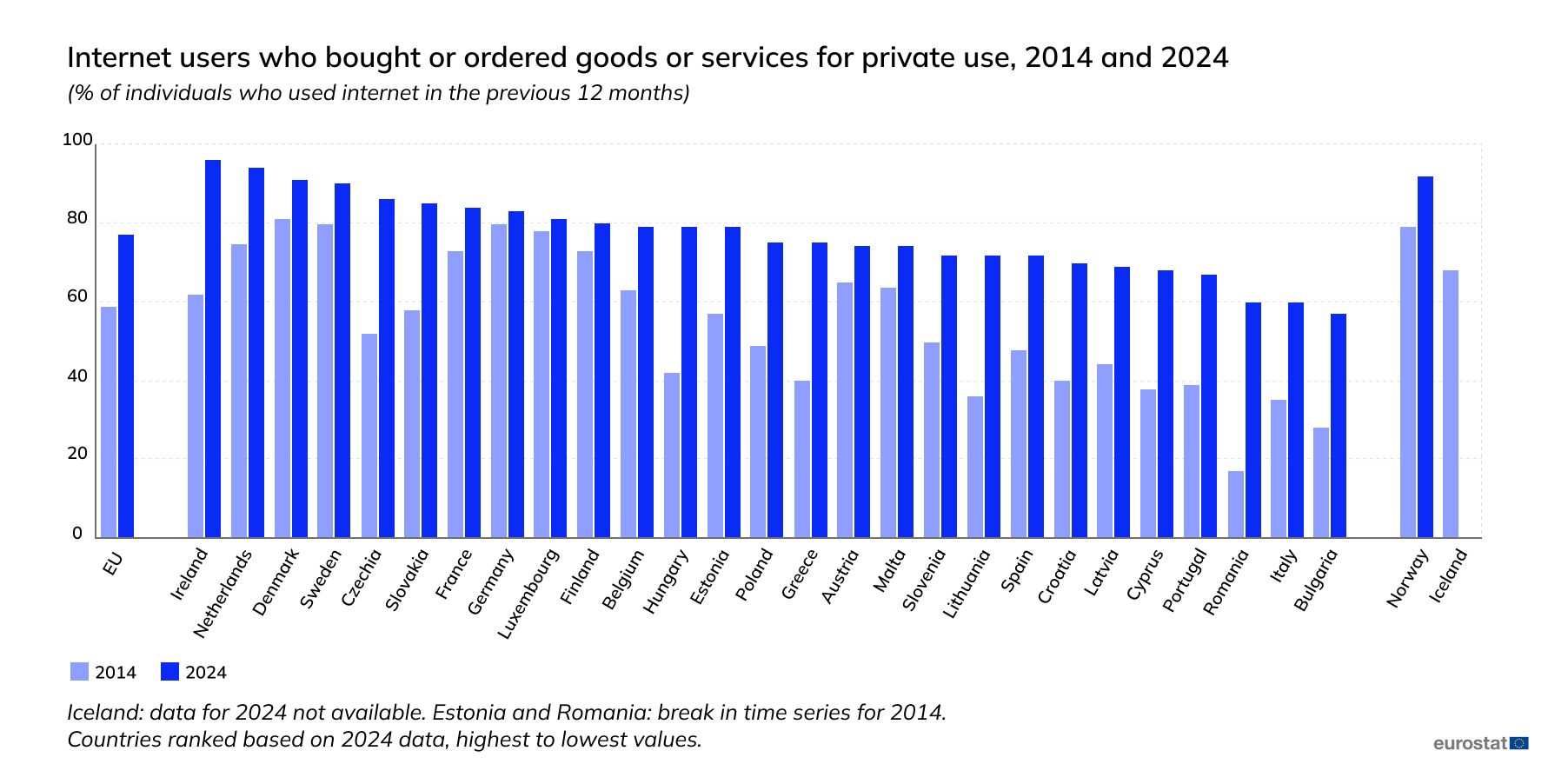

According to the Eurostat report on online shopping demographics, in 2024, 77% of EU internet users aged 16 to 74 made at least one online purchase during the year. This demonstrates the consistent growth of e-commerce across Europe and the expanding base of digital consumers.

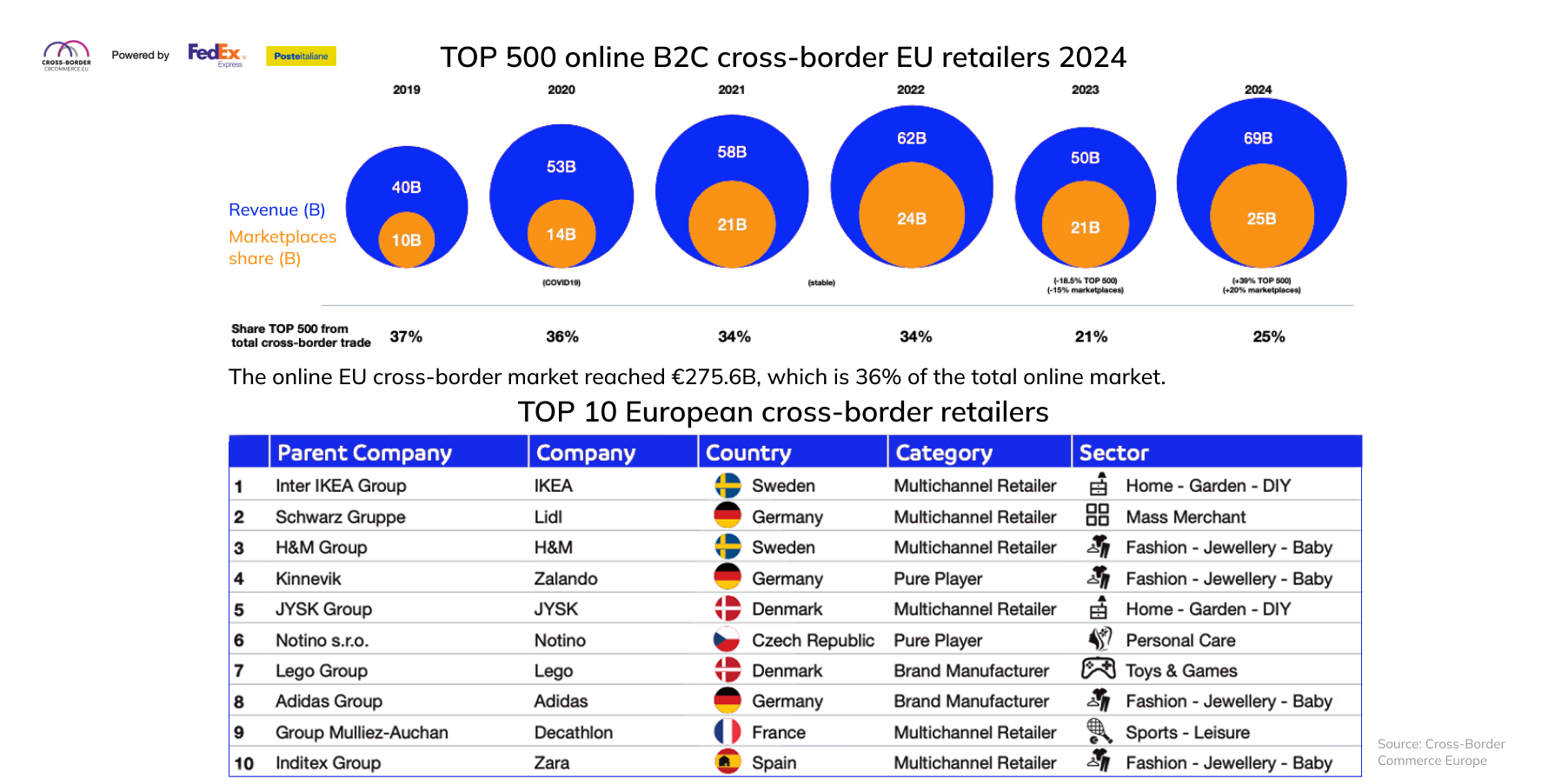

Cross-border sales are gaining momentum faster than ever. Cross-Border Commerce Europe reports that in 2024, its total volume reached €275.6 billion, accounting for 36% of Europe’s online e-commerce market. What are people buying online? The leading categories continue to be fashion, consumer electronics, and home goods.

The European E-commerce Report 2024 highlights that European retailers are increasingly entering new markets. More companies are selling to other EU countries or planning to expand their cross-border presence in the coming years. According to internet shopping statistics, this shift is powered by growing interest in international products and the ongoing development of online shopping infrastructure.

Among the main factors driving this expansion are:

- Simplified logistics and delivery processes, supported by the development of European postal and courier networks.

- Harmonized tax regulations under the Digital Single Market, an EU initiative designed to make cross-border online trade easier.

- The rise of localized payment systems enables shoppers to make purchases in their local currency with minimal fees.

The Cross-Border Commerce Europe e-commerce report notes that the largest share of sales comes from multichannel retailers such as IKEA, Lidl, H&M, Zalando, Lego, Adidas, and Zara.

Their strong performance shows that cross-border trade has become a key growth driver of Europe’s e-commerce sector. Leading companies are investing heavily in logistics, localization, and technology to scale efficiently across multiple markets.

By 2026, international online sales are expected to continue growing, supported by integrated logistics solutions, digital customs services, and the expanding adoption of “buy now, pay later” models.

This creates new opportunities for brands aiming to scale beyond their home markets without maintaining a physical presence in every country.

EU Regulations Strengthen Transparency and Security

Based on online shopping stats from Eurostat, consumers across Europe now expect e-commerce platforms to ensure complete protection of their data and payment information. In 2026, the EU digital market will enter a new phase of regulation as three major legislative acts come into force. These laws aim to enhance transparency, security, and accountability across the e-commerce industry.

- The AI Act — the world’s first comprehensive law on artificial intelligence — was adopted in 2024 and will fully take effect in 2026. It outlines how businesses should apply AI responsibly in products, advertising, services, and customer interactions. For online stores and platforms, this means that algorithms designed to influence consumer behaviour or pose potential risks to users are not allowed. Companies must also clearly indicate when recommendations or decisions are generated by AI, helping consumers understand how these systems function. Read more about the practical use of AI in e-commerce in our article.

- The PSD3/PSR introduces new rules from the European Commission governing payment services within the EU. It aims to make online payments safer and strengthen user rights. The updated framework improves fraud prevention, introduces standardised identity verification procedures, and modernises open banking — enabling users to access multiple financial services seamlessly through a single app. These measures are expected to boost trust in online transactions and reduce fraud in the payment sector.

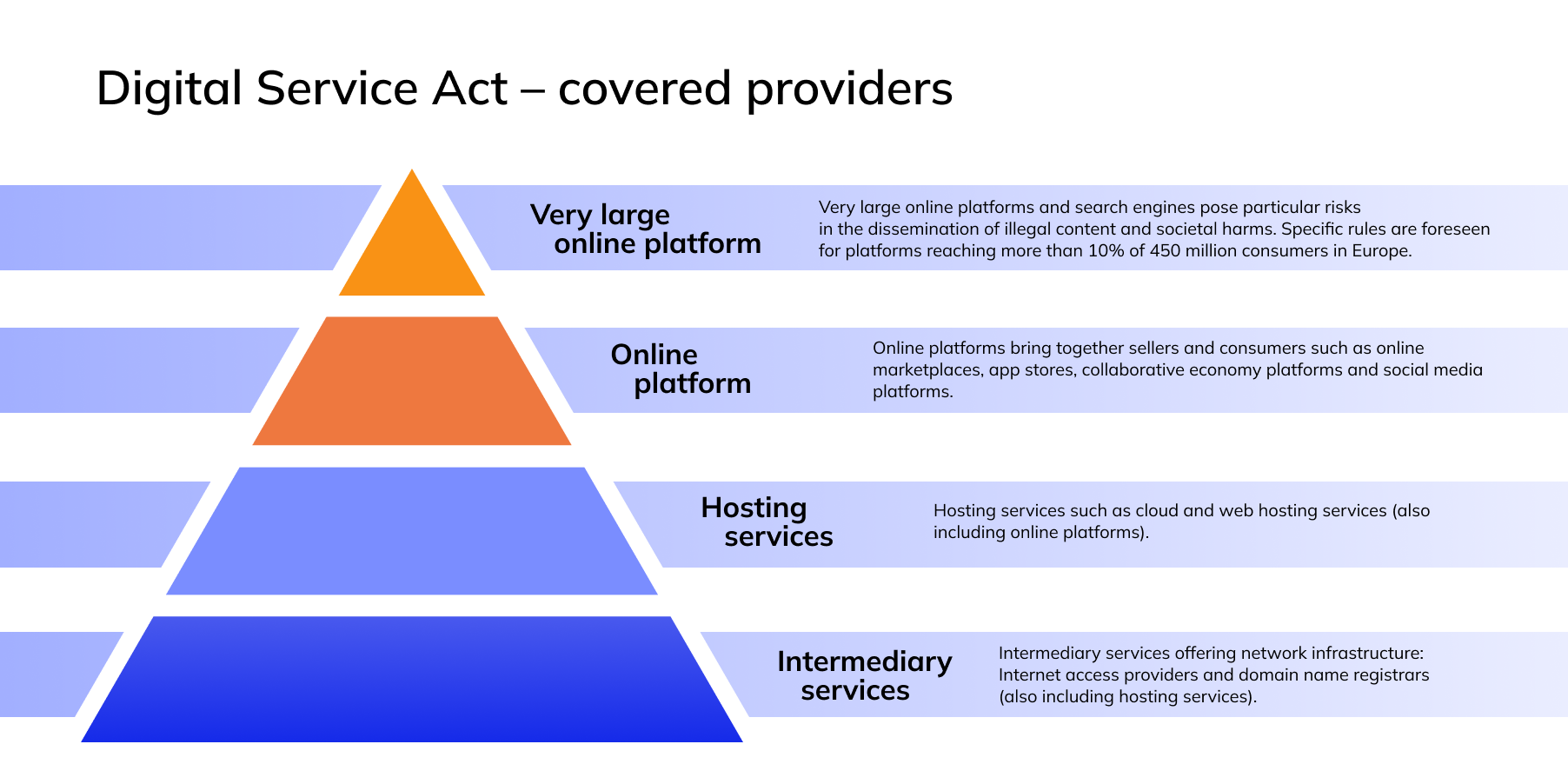

- The DSA (Digital Services Act), set to take full effect in 2026, strengthens the accountability of online platforms and marketplaces for content, advertising, and consumer protection. It applies to various types of digital intermediaries — from basic intermediary services (like internet providers) and hosting services to online platforms and very large online platforms with over 45 million active EU users. For businesses, this means mandatory advertising transparency, verification of sellers, and prompt action against illegal products or content.

Together, these three acts set a new benchmark for transparency and security in online business across the EU. Companies that adopt these principles early will not only ensure compliance but also strengthen customer trust and gain a competitive advantage.

Marketplaces Strengthen Their Position, While Direct Sales Are Being Redefined

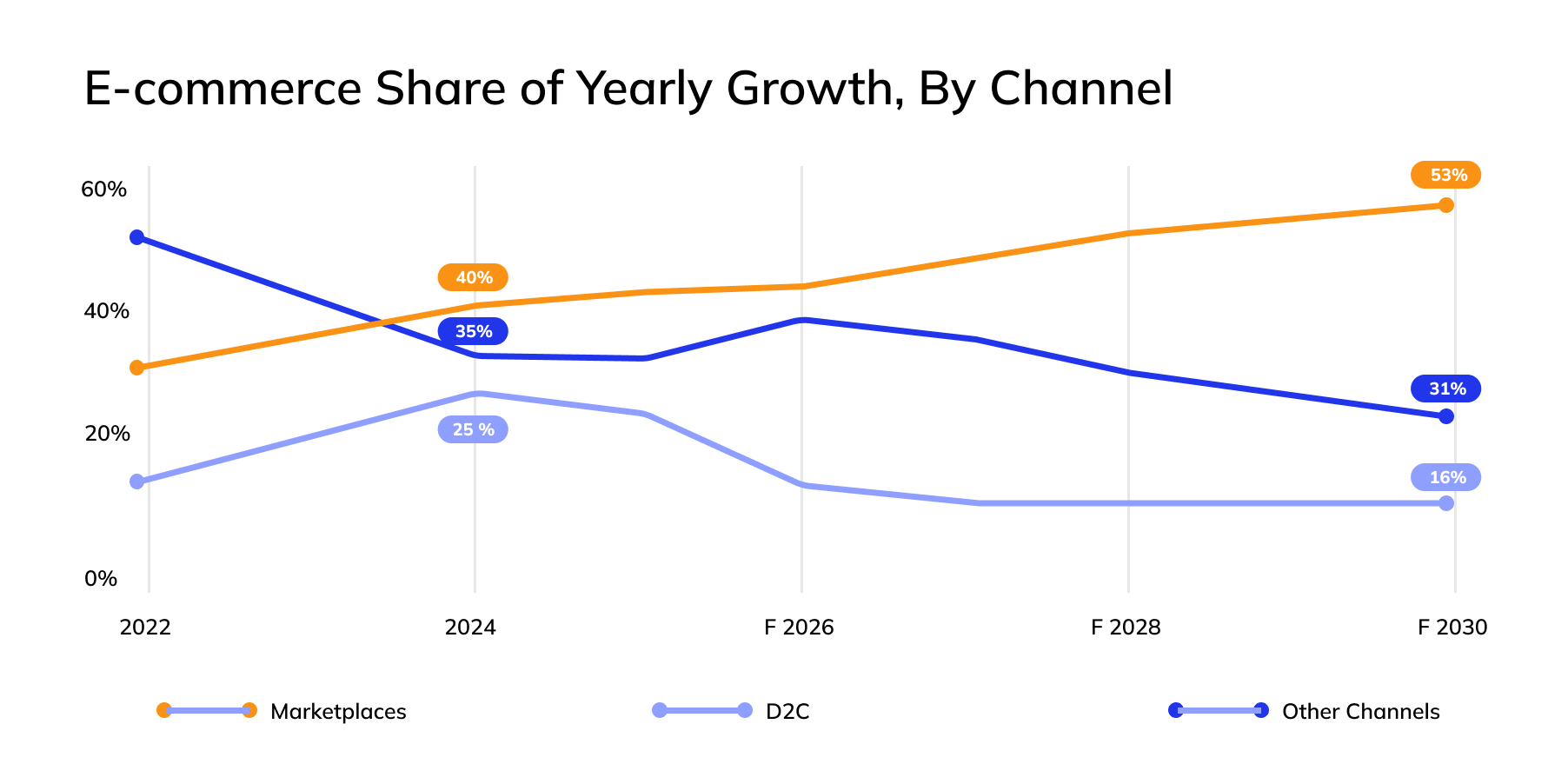

According to e-commerce statistics from Cymbio, marketplaces will continue to expand their share of the global online market, from 40% in 2024 to 53% by 2030.

At the same time, the D2C (Direct-to-Consumer) segment is expected to decline from 25% to 16%, as brands face rising customer acquisition costs and growing competition for attention.

These online shopping statistics show that marketplaces are becoming the foundation of e-commerce. They connect buyers and sellers, handle analytics, payments, and logistics, and simplify the entire sales process. A clear example of this model is the ServiCom marketplace, which covers the full cycle of B2B and B2C sales — from product listings to payment and delivery. The platform enables companies to find buyers, close deals, and manage all transactions in one environment without intermediaries or complex integrations.

At the same time, the D2C model retains its strategic importance. A brand’s own online channel allows it to:

- maintain profit margins without marketplace commissions;

- collect first-party data, which becomes crucial as third-party cookies gradually disappear;

- build loyalty through a unique customer experience.

By 2026, the optimal strategy is a hybrid approach — combining presence on major marketplaces to reach new audiences with the development of a D2C channel as a hub for interaction, personalization, and analytics.

What Businesses Should Do Now

To adapt confidently to the changing landscape, companies should start preparing in advance.

- Localize offers, payments, and delivery. Translate websites and catalogues into the languages of target markets, taking into consideration local currencies, tax rates, return policies, and consumer habits. This approach boosts conversion and trust — especially in cross-border sales.

- Review transparency and accountability policies. In line with DSA requirements, implement partner verification, clear advertising rules, transparent consumer communication, and effective complaint-handling procedures.

- Assess your use of artificial intelligence. Audit recommendation algorithms, chatbots, personalization tools, and demand forecasting systems to ensure compliance with the AI Act. All AI-generated decisions must be transparent to users.

- Prepare for new payment standards under PSD3/PSR. Strengthen payment gateway protection, enable two-factor authentication, and test integration with banking APIs. Payment security and convenience will be crucial for retaining customers.

- Invest in first-party data. Collect data ethically — through subscriptions, loyalty programs, and personalized offers. By analysing consumer behaviour and trends (for example, what do people buy the most online), businesses can better predict demand and create relevant campaigns. This helps compensate for the loss of third-party cookies while improving analytics, marketing, and customer insights.

Companies that start adapting in 2025 will gain a strong edge in 2026 — enabling them to complete certifications more quickly, prevent fines, and build stronger customer trust.

Conclusion

The year 2026 represents a new phase of maturity for Europe’s e-commerce sector. The rise of cross-border sales, the integration of local payment methods, and the evolving regulatory environment are shaping a market where transparency and security are not optional — they are the standard.

Businesses that already analyze e-commerce data and proactively adapt their models will gain a competitive edge. The future of online trade in Europe belongs to those who combine flexibility, accountability, and strategic vision.