Why BankID and MitID Are Becoming the Standard for Business Identification in Online Commerce

August 13, 2025

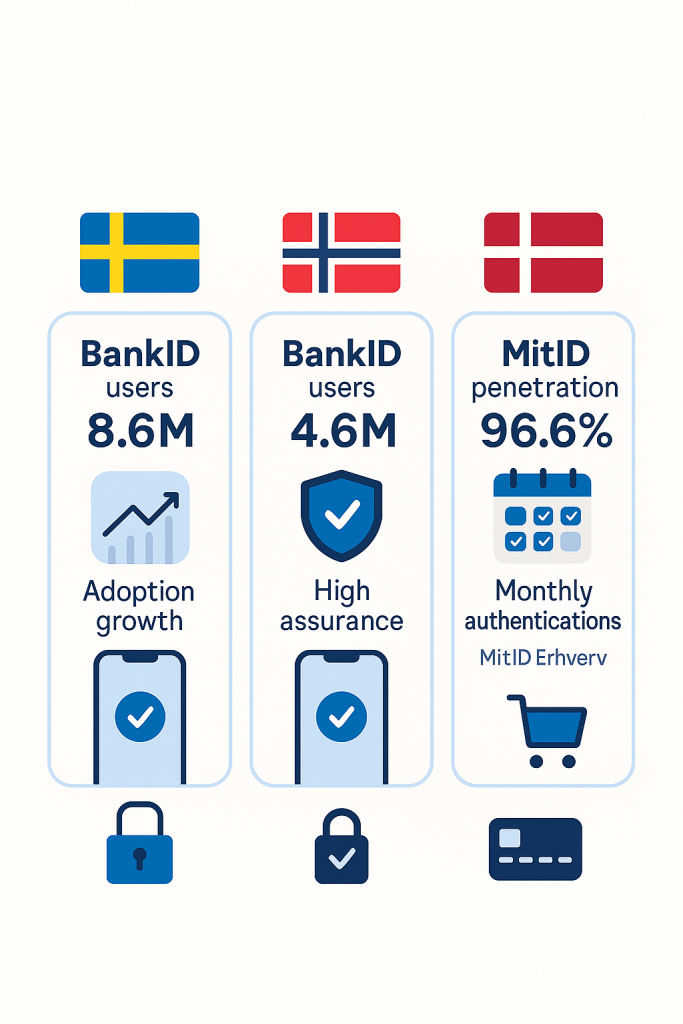

Modern e-commerce lives or dies on trusted, instant identification. In the Nordics, BankID (Sweden & Norway) and MitID (Denmark) now power everything from logins to legally binding signatures—and businesses are standardizing on them because conversion, compliance, and coverage all improve at once. Sweden alone counts 8.6 million BankID users in 2024, Denmark reports 96.6% MitID penetration among 15+ residents, and 4.6 million Norwegians use BankID.

The business problem these eIDs solve

Merchants must cut fraud without killing checkout. Regulations like PSD2 Strong Customer Authentication (SCA) and anti-money-laundering rules force stronger, multi-factor identity—and poor UX can crush conversion. Bank-issued eIDs solve both: high-assurance authentication that users already know, delivered in seconds at payment, sign-up, or contract steps.

Why Nordic bank-backed eIDs win at checkout

- Massive coverage = fewer fallbacks. BankID and MitID reach the overwhelming majority of local customers, so you can default to the strongest flow without adding frictiony backups.

- Built for assurance. Swedish BankID is approved under eIDAS at “Substantial” LoA; MitID supports Substantial and High; Norwegian BankID operates at Substantial with paths to High for sensitive cases.

- Legally robust signing. Both ecosystems support qualified or advanced e-signatures and binding approvals—ideal for B2B contracts, subscriptions, credit, and telco flows.

- Trusted habit = higher conversion. Nordic users authenticate daily with these apps, so “verify with BankID/MitID” feels familiar, fast, and safe.

Quick comparison: coverage, assurance, usage

| Country | Primary eID | Adoption snapshot | eIDAS/Assurance | Typical business uses |

|---|---|---|---|---|

| Sweden | BankID | 8.6M users (2024) | Substantial LoA | Login, payments SCA, e-signing |

| Norway | BankID | 4.6M users (≈90% eligible) | Substantial (paths to High for some flows) | Login, e-signing, regulated on-boarding |

| Denmark | MitID / MitID Erhverv | 96.6% of 15+ have MitID; 89M monthly auths (avg. 2024) | Substantial & High | Login, e-signing, acting on behalf of a company |

How they enable business identification—not just personal KYC

B2B commerce needs to know who is acting and for which entity/role.

Here’s how BankID/MitID support that:

- Verify the person with eID (BankID/MitID) at strong LoA.

- Bind the person to the company role using official registries and role/mandate checks in your back end or through your integrator. Denmark formalizes this via MitID Erhverv, letting employees/owners act on behalf of the company. Norway and Sweden commonly pair BankID login with registry lookups before allowing corporate actions.

- Capture a binding signature with the same eID to finalize contracts, orders, or mandate approvals.

B2B action map (what to use when)

| Step | Goal | Recommended eID action |

|---|---|---|

| Company account creation | Verify authorized representative | BankID/MitID auth + role/registry check |

| Credit line or subscription | Capture enforceable consent | e-signature with BankID/MitID |

| High-risk order (electronics, telco, prepaid) | Meet tightened ID rules & SCA | BankID/MitID step-up before fulfillment |

| Admin changes (beneficiaries, limits) | Non-repudiation | Re-authenticate + sign with eID |

Compliance tailwinds: eIDAS 2.0 & EU Digital Identity Wallets

eIDAS 2.0 entered into force on 20 May 2024, and the Commission adopted additional implementing regulations in May 2025. By 2026, Member States must offer at least one EU Digital Identity Wallet. Nordic eIDs already meet key assurance and interoperability requirements, positioning merchants to reuse high-assurance identity across borders.

Impact on metrics that matter

- Higher conversion at login/checkout. Users know the flow; fewer abandonments versus unfamiliar KYC hurdles. (Nordic online payments and e-commerce activity continue to rise, reinforcing user comfort with digital flows.)

- Lower fraud & chargebacks. Strong, bank-grade authentication plus binding signatures deter account takeovers and repudiation.

- Audit-ready compliance. LoA mapping to eIDAS and sector rules simplifies audits and cross-border acceptance.

Implementation blueprint for merchants & platforms

- Choose your integration path. Either connect directly to national eID services or use an eID hub/aggregator that offers BankID (SE/NO) and MitID from one API with LoA controls.

- Map assurance to risk. Require Substantial for standard logins and SCA, and step up to High (where available) for sensitive B2B actions.

- Add role checks for B2B. After eID auth, validate company roles/mandates (e.g., via MitID Erhverv in DK) before allowing admin or contractual actions.

- Offer e-signing as a native step. Let customers sign orders, MSAs, mandates, and renewals without leaving your flow.

- Design for habit. Default to eID where available; keep SMS/OTP only as a fallback. Educate users at first use, then rely on one-tap app approvals. (MitID reports weekly usage by 87% of users—this is a habit loop you can leverage.)

Nordic snapshot: where each eID shines

- Sweden (BankID). Near-universal adoption; ubiquitous for banking, e-commerce SCA, and signatures. 8.6M users in 2024.

- Norway (BankID). ~4.6M users; the default for authentication and e-signing across sectors.

- Denmark (MitID & MitID Erhverv). National default for citizens and companies to act on behalf of entities; 96.6% of 15+ have MitID.