How to Distinguish a Real Manufacturer from an Intermediary When Shopping Online

August 16, 2025

Buying direct from a true manufacturer can cut costs, improve quality control, and speed up custom work. But online, manufacturers, trading companies, wholesalers, and dropshippers often look the same. This guide gives you a practical, proof-based method to tell them apart—fast.

TL;DR: The 3-Step “Proof, Process, Paperwork” Test

Start with a quick triage. If a site fails any one of these, proceed with caution.

- Proof: Can they show credible evidence of production (factory address, equipment, in-house QC, production team, OEM/ODM)?

- Process: Do MOQs, lead times, and engineering support match a factory’s reality (not a reseller’s)?

- Paperwork: Do legal records, compliance certificates, and identifiers (VAT/EIN, ISO, CE/FCC/UL, GS1 barcodes, trademarks) trace back to them?

If all three align, you’re likely dealing with a real manufacturer.

Why distinguishing matters

A real manufacturer usually gives better unit economics at scale, tighter quality control, and faster customizations. An intermediary can be useful for small runs or multi-category sourcing, but you’ll pay extra margins, face inconsistent quality, and rely on second-hand information for compliance and warranty. Knowing which is which lets you set the right expectations (and contracts).

Evidence on the website: signals that actually prove things

Look for specific, verifiable details—not vague claims.

- Factory footprint: Street-addressed facilities, floor area, machinery lists, process photos/videos, and in-house lab/QC descriptions.

- People & roles: Named engineers, production managers, and quality leads; a careers page hiring machinists, operators, SMT techs—not only sales reps.

- Process depth: BOM materials, tolerances, certifications mentioned by scope (e.g., “Design & manufacture of…”), and QC stages tied to standards.

- Narrow specialization: Focused product families and deep technical pages (drawings, CAD notes, maintenance specs) beat “we sell everything” catalogs.

The table you can actually use

| Check | What to do | Likely manufacturer signal | Likely intermediary signal |

|---|---|---|---|

| Legal entity | Look up company registration, VAT/EIN, business registries in the firm’s country. | Records match site name, address, and activity (manufacture/production). | Recent shell entity, mismatched addresses, “virtual office”. |

| Factory address | Verify on maps/street view; request a live video walk-through. | Industrial site, loading bays, signage; floor space consistent with output. | Coworking or residential address; no site visit possible. |

| Certifications | Ask for ISO 9001 scope, CE/FCC/UL file numbers; verify in accreditors’ directories. | Certificate holder’s name matches vendor; scope includes manufacture. | Certificates belong to someone else, wrong scope, or unverifiable. |

| Barcodes/GTIN | Check GS1 ownership of brand/prefix. | Brand’s GS1 data points to the same company. | GTINs registered to a different company (or none). |

| Trademarks | Search brand in TM databases (WIPO/EUIPO/TMview). | Trademark owner is the same entity at the same address. | Mark owned by another party; seller has only “authorization”. |

| Product range | Scan catalog breadth and depth. | Tight family, deep specs, custom options. | Hundreds of unrelated SKUs; generic descriptions. |

| MOQ & lead time | Ask for MOQ by customization level; ask capacity numbers. | Higher MOQs for custom parts; lead times tied to line capacity. | Any MOQ you want; vague, shifting lead times. |

| Engineering support | Ask technical questions (tolerances, materials, test methods). | Precise answers from engineers; sample control plans. | Sales answers only; “we’ll ask factory” repeatedly. |

| Warranty/RMA | Request RMA workflow and failure analysis examples. | In-house FA reports; clear RMA addresses and timelines. | Returns go to “partner warehouse”; no FA capability. |

| Pricing behavior | Test volume tiers and change requests. | Transparent cost drivers; stable quotes tied to materials and process. | Price swings without explanation; pushes prepayment before tech details. |

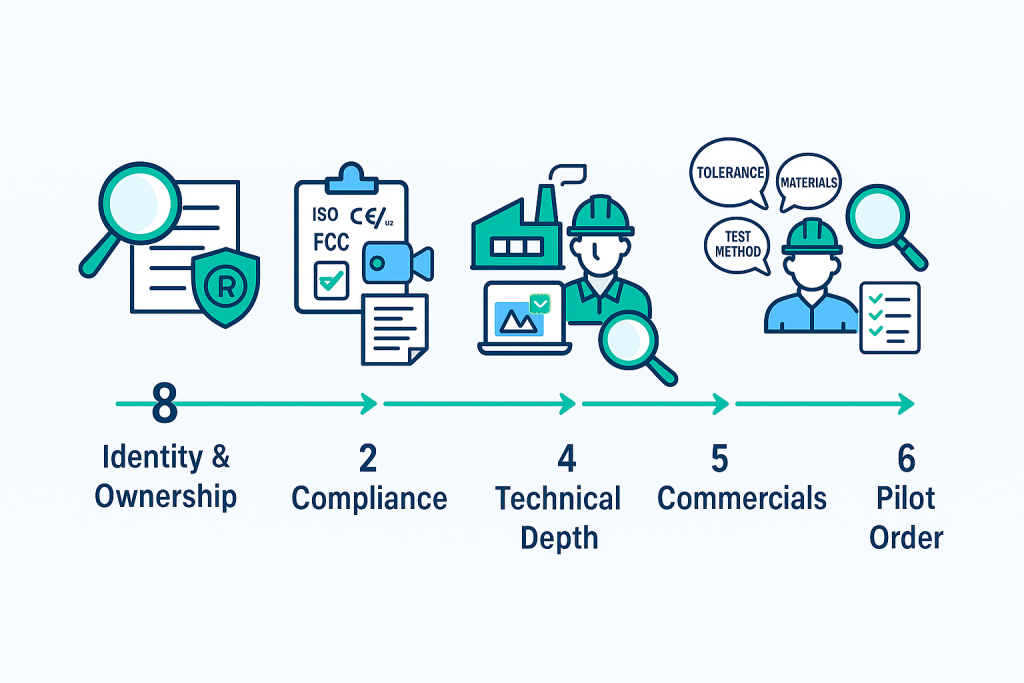

A step-by-step due-diligence workflow (works for B2B and advanced B2C)

Follow these steps; you’ll filter 80–90% of risky suppliers in days, not weeks.

- Identity & ownership

- Match website name, legal company name, and registered address.

- Confirm VAT/EIN (or local equivalents).

- Optional: check the D-U-N-S number (Dun & Bradstreet) for a quick credit/identity snapshot.

- Brand & product ownership

- Search the brand in national/international trademark databases.

- For packaged goods, check GS1 (UPC/EAN/GTIN) ownership for the brand/prefix.

- Compliance trail

- Request ISO 9001/14001 certificate with scope that includes manufacturing.

- For regulated goods, ask for CE DoC, FCC ID, or UL file number (as applicable) and verify them in the official directories.

- Ask for supporting lab reports (test house, date, model, standard).

- Production reality check

- Ask for a 10–15 minute live video walk-through: materials receiving → production → QC → packing.

- Request production photos with today’s date/PO number on a whiteboard to avoid stock photos.

- Probe capacity: lines, shifts, monthly units, bottlenecks.

- Technical depth

- Send a short spec sheet and ask three precise questions (e.g., tolerance, finish, test method).

- Ask for a sample control plan or PFMEA summary for your SKU type.

- Commercials

- Compare quoted MOQs and lead times by customization level.

- Request tiered pricing with material and process levers called out.

- Confirm RMA/Warranty procedures and failure analysis capability.

- Pilot before commitment

- Place a small, instrumented pilot order with measurable acceptance criteria.

- Inspect incoming goods (AQL), document defects, and review their corrective action.

Marketplace reality: reading signals on platforms

Marketplaces blur lines between factories and traders. Here’s how to read them.

- Business type vs reality: Profiles may show “Manufacturer & Trading”; judge by catalog focus, factory content, and engineering replies.

- SKU focus: Source manufacturers usually cluster around a narrow family (e.g., only injection-molded organizers). Traders list unrelated categories.

- Certificates & audits: Favor suppliers whose certificates and factory audits name the same company as the storefront.

- OEM/ODM confidence: Real OEM/ODM can explain tooling, DFM, and change control; traders repeat marketing phrases.

Red flags that scream “intermediary”

- “We can make anything” catalogs with inconsistent specs.

- Certificates without file numbers, wrong company names, or missing test reports.

- Returns routed to a different company/country than the seller.

- Only sales contacts, zero production or quality contacts.

- Prices change wildly with no explanation tied to materials or process.

- Reluctance to show the factory on live video or to share capacity numbers.

What manufacturers typically look like

- Focused product lines, deep spec pages, and process transparency.

- In-house or formally contracted QC/lab capabilities.

- OEM/ODM documentation (tooling ownership, DFM notes, ECN/change logs).

- Career postings for production and engineering roles.

- Stable pricing tiers linked to material and throughput, not guesswork.

What intermediaries often look like

- “Everything store” catalogs, stock photos, and generic descriptions.

- Certificates that don’t verify or belong to someone else.

- No factory walk-throughs, no production roles, only responsive sales chat.

- MOQs and lead times that magically fit any buyer’s request.

- Warranty handled by “partner warehouses” with no root-cause analysis.

Buyer checklists you can copy

Documents to request (and verify):

- Legal: registration extract, VAT/EIN (local equivalent).

- Ownership: trademark registration for the brand you’ll buy; GS1 prefix/GTIN ownership for the barcode on packaging.

- Quality: ISO 9001 certificate with scope, recent audit summary.

- Safety/Regulatory (as applicable): CE Declaration of Conformity + test reports; FCC ID grant and test reports; UL file number; material certificates.

- Operations: capacity statement (lines, shifts, monthly units), lead time ladder, RMA workflow.

Questions for your first call:

- What’s your monthly capacity for this exact product family?

- What’s your typical first-article lead time and tooling ownership policy?

- Which standards do you test to, and where are tests performed?

- Can we set up a 10-minute live video walk-through this week?

- Who is the engineering contact for DFM and change control?