How the Electronics Market in Europe is Changing: Demand, Logistics, and Consumer Expectations

July 24, 2025

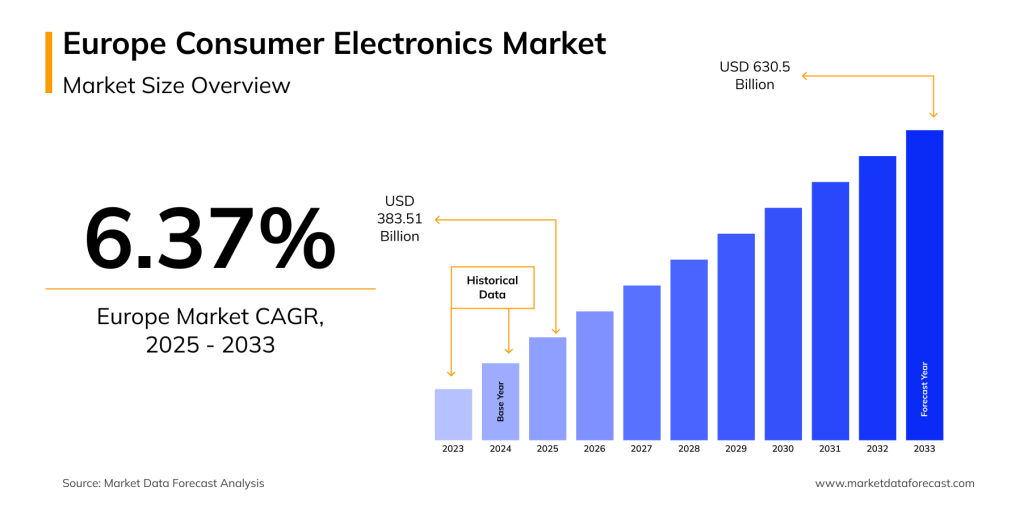

The European electronics market is currently valued at approximately $360.5 billion, according to Market Data Forecast. Consumer demands are rising, and competition is becoming more intense. Below, we’ll examine the key opportunities and challenges shaping the industry in the coming years—and how businesses can position themselves to gain from these shifts.

What Modern Consumers Look for in Electronics

Market Data Forecast projects that the consumer electronics market will grow at a compound annual rate of 6.37% through 2030. Constant interaction with technology has shaped a new generation of buyers — more selective, environmentally aware, and digitally fluent.

To stay competitive, companies need to focus on the solutions buyers care about most:

- Smart Devices.In Europe, demand for these products is rising quickly. Many households are adopting smart home technology to improve security, manage systems remotely, and save time on daily routines.

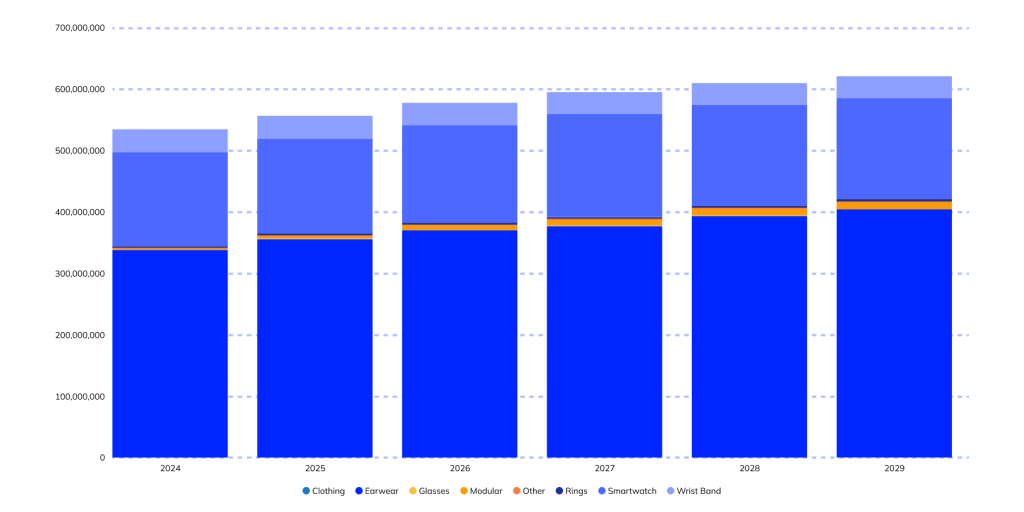

- Wearable Devices. The largest share belongs to headphones, followed by smartwatches, bracelets, and rings that monitor health. According to International Data Corporation (IDC), the global market for these products reached 534.6 million USD in 2024. Their popularity is growing alongside the trend toward a healthy and comfortable lifestyle.

- Wearable Devices. Headphones hold the largest market share, followed by smartwatches, fitness bracelets, and health-tracking rings. International Data Corporation (IDC) reports that the global market for these devices reached $534.6 million in 2024. Their rising popularity reflects the growing focus on health and everyday convenience.

- 5G Technology. The Ericsson Mobility Report 2024 estimates that by 2030, 67% of all mobile subscriptions worldwide will use 5G. This shift is fueling consistent growth in sales of smartphones and tablets that support the network.

- AR/VR Products. Virtual reality is still emerging in the market, but strong growth is anticipated. Its applications now go beyond entertainment and gaming, extending into healthcare and education.

- Eco-friendly Electronics. An NIQ report shows that by 2023, 36% of European electronics consumers preferred energy-efficient products to save money and reduce environmental impact. Rising awareness is prompting both consumers and major brands to factor sustainability into their choices.

Convenient, advanced, and sustainable electronics are a priority across Europe. Suppliers and retailers that adapt quickly to the expectations of today’s buyers are more likely to stay ahead of the competition.

How to Manage Main Electronics Logistics Challenges

Even leading companies like Apple and Huawei have encountered supply chain issues, pushing them to seek more adaptable solutions. According to Market Data Forecast, the average delivery time in the industry has increased by 30%.

Key Reasons Behind Supply Chain Disruptions

- Dependence on Asian suppliers. A significant portion of electronics manufacturing is concentrated in Asia, particularly Taiwan. Geopolitical tensions in the region cause supply interruptions.

- Semiconductor shortage. The need for microchips exceeds production capacity, delaying device assembly and product delivery.

- Labor shortages and port congestion. Ports and logistics firms face challenges managing high shipment volumes amid staffing shortfalls.

As a result, costs are increasing and customer trust is eroding. To remain competitive, businesses must take proactive steps. Below are several strategies to navigate changes in Europe’s electronics supply chains.

- Supplier diversification. Working with suppliers from multiple regions reduces reliance on any single market and minimizes the risk of delays.

- Building strategic inventory. Keeping backup stock enables companies to continue sales during unexpected disruptions.

- Expanding local supply and electronics manufacturing. Supporting regional production strengthens local businesses and lowers exposure to geopolitical risks.

- Sustainable logistics practices. Using eco-friendly packaging, selecting green carriers, and complying with regulations help ensure long-term growth and reduce delays from bureaucratic processes.

Logistics in the electronics sector remains a major challenge, even for industry leaders. Yet, the appetite for tech products continues to rise. Companies that adjust swiftly to these changes will uncover strong opportunities for growth.

European Electronics Trends: New Demands and Business Opportunities

To succeed in the European electronics market — whether entering or expanding — companies must stay attentive to evolving consumer behavior and regulatory updates. Here’s where to focus to build a strong position in this niche.

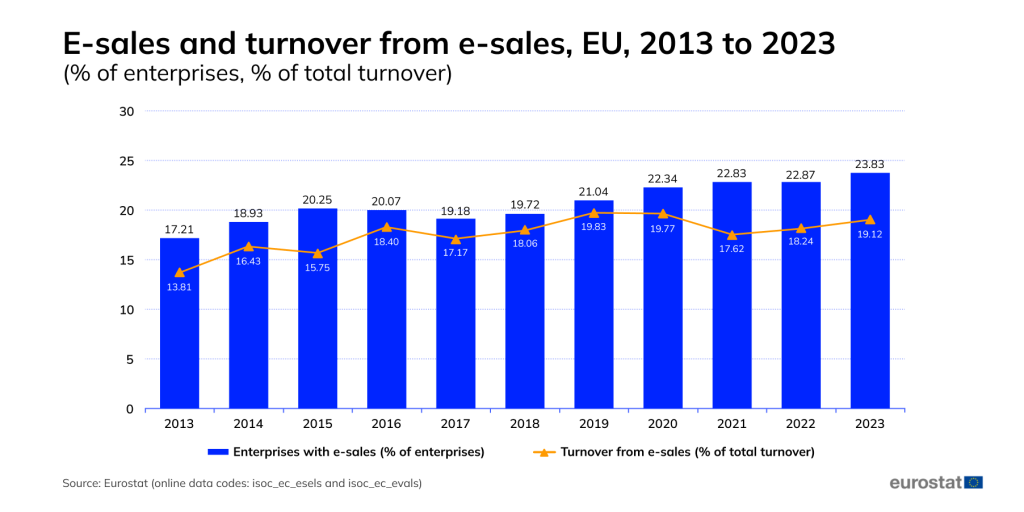

- Online Sales. Cross Border Commerce Europe forecasts that by 2026, almost half of the market’s total value will come from online electronics sales. Consumers increasingly prefer e-commerce for its speed and convenience. Eurostat data also reveals that between 2013 and 2023, more companies have actively developed and benefited from online trade.

- Environmental Regulations. In 2024, the EU introduced the Ecodesign for Sustainable Products Regulation, mandating that products minimize carbon emissions and be repairable and recyclable. For many consumers, these criteria have become essential in their purchasing decisions. Companies that meet these standards gain a competitive advantage in the market.

- Focus on the Local Market. Inflation and economic uncertainty have led some buyers to seek more affordable tech options. Future Market Insights highlights this as an opportunity for local manufacturers and suppliers, who can offer competitive prices without sacrificing quality, and gain an advantage in the process.

Companies that blend innovation, sustainability, and deep knowledge of the local market will see greater engagement.

5 Key Tips to Boost Electronics Sales

As the industry expands, competition intensifies. With current trends, the electronics sector is drawing significant attention. So, where and how should you sell to succeed confidently in the European electronics market?

-

- Keep up with trends. Today’s buyers have shifting priorities and preferences. Analyze their needs and offer products that match.

- Verify quality and sustainability. Selling in Europe requires certifications such as CE, RoHS, WEEE, and the Energy Label for energy-consuming items. These certifications reassure customers that you are a responsible and reliable seller.

- Ensure logistics flexibility. Work with multiple suppliers, keep backup stock, and set up alternative delivery routes to ensure fast delivery of electronics to customers.

- Prioritize customer comfort. Beyond offering products that simplify daily life, customer service in the electronics sector should be hassle-free. Ensure prompt communication, secure packaging, and transparent information about your business.

- Grow your online sales. Forecasts indicate that between 2025 and 2033, the online electronics segment will expand at an average annual rate of 12.1%. This presents a strong opportunity to scale by reaching a broader audience, especially through marketplaces—channels that offer convenience, wide reach, and consumer trust.

To stay close to customers and respond swiftly to market shifts, opt for convenient formats for online electronics sales. Online marketplaces lower startup costs, simplify logistics, and connect you with an established audience. Consider listing your products on ServiCom — a platform with straightforward terms, built-in promotion tools, and a strong focus on your success.