How Online Payment Differs in B2C and B2B Transactions

August 9, 2025

Online payments look similar on the surface: a cart, a checkout, a confirmation. Under the hood, B2C and B2B operate on very different rules. The gap shows up in order size, who approves the payment, how money moves, and how systems reconcile it.

This guide explains the practical differences, with tables, checklists, and KPIs you can act on today.

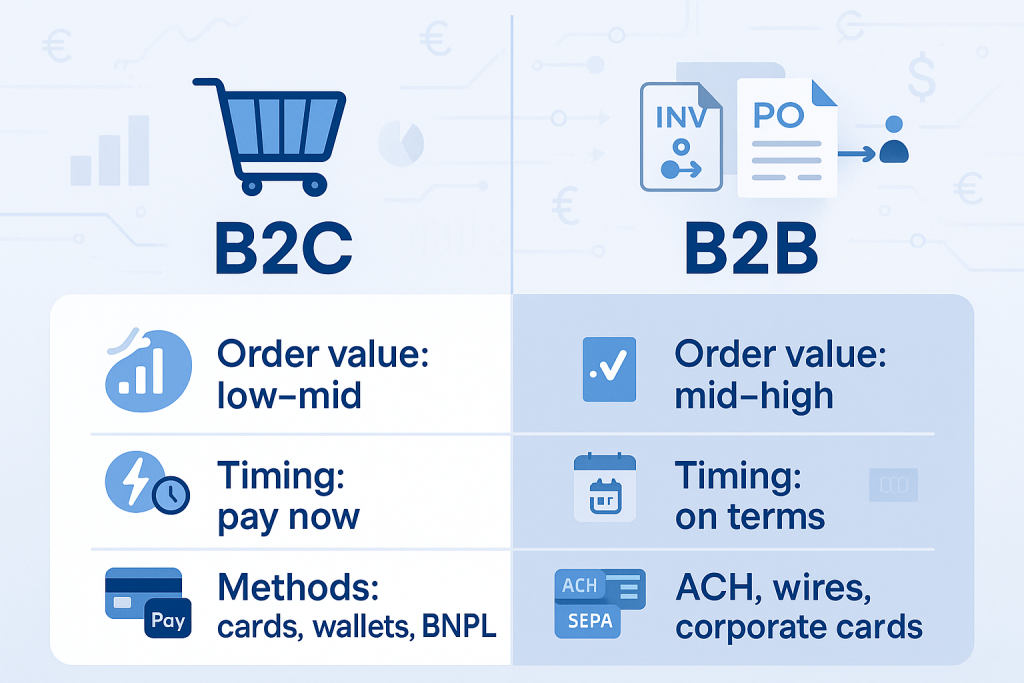

The core difference: who pays—and how decisions are made

B2C payments involve a single consumer paying immediately at checkout. The main goals are speed, conversion, and low friction.

B2B payments happen between organizations. Multiple stakeholders may review the order, apply negotiated pricing, and pay later on terms. The goal is accuracy, compliance, and cash-flow control.

At-a-glance: B2C vs B2B online payment

| Dimension | B2C (consumer checkout) | B2B (business checkout) | Why it matters | KPIs to watch |

|---|---|---|---|---|

| Typical order value | Low to medium | Medium to very high | Impacts fraud tooling, SCA/3DS strategy, and fees | AOV, approval rate |

| Payment timing | Instant at checkout | Immediate or on terms (Net 15/30/60) | Affects cash flow and credit risk | DSO, days to collect |

| Methods | Cards, wallets, BNPL, bank pay | ACH/SEPA, wires, cards, virtual cards, POs, BNPL-for-business | Drives processor selection & routing | Method mix %, cost per method |

| Pricing | List price, promos | Contract, tiered, customer-specific | Requires account pricing at checkout | Price override accuracy |

| Approval flow | None/one click | Multi-user, role-based approval | Needs account hierarchies & audit logs | Time-to-approve |

| Tax handling | Simple VAT/sales tax | VAT IDs, exemptions, reverse charge | Requires robust tax engine | Tax error rate |

| Invoicing | Receipts | Invoices, POs, partials, credit notes | Tight ERP/AP integration needed | Invoice match rate |

| Risk & disputes | Higher chargeback frequency | Lower consumer-style chargebacks, higher invoice disputes | Different prevention & case ops | Dispute rate by reason |

| Reconciliation | Simple, per order | Remittance advice, bulk pay, level 2/3 data | Impacts accounting close speed | Auto-recon % |

Payment methods and terms

Consumers prefer instant, low-friction methods—cards, Apple/Google Pay, local wallets, and consumer BNPL.

Businesses often need methods that minimize fees at high values (ACH/SEPA, wires), support remittance data, or align with procurement (POs, corporate/virtual cards). Terms (Net 30, partial payments, milestones) are common in B2B and must be reflected at checkout, not handled via email later.

Implementation tips

- B2C:Offer cards + top two local wallets; add account-updater and network tokens to lift approvals.

- B2B:Enable ACH/SEPA and wires alongside cards; supportnet termswith automated credit checks and limits.

Checkout and account experience

B2C checkouts win by being fast and familiar. Autofill, one-click, and guest checkout reduce abandonment.

B2B checkouts must model real buying: account-level pricing, quotes to order, PO fields, split shipments, multi-address shipping, and role-based approvals.

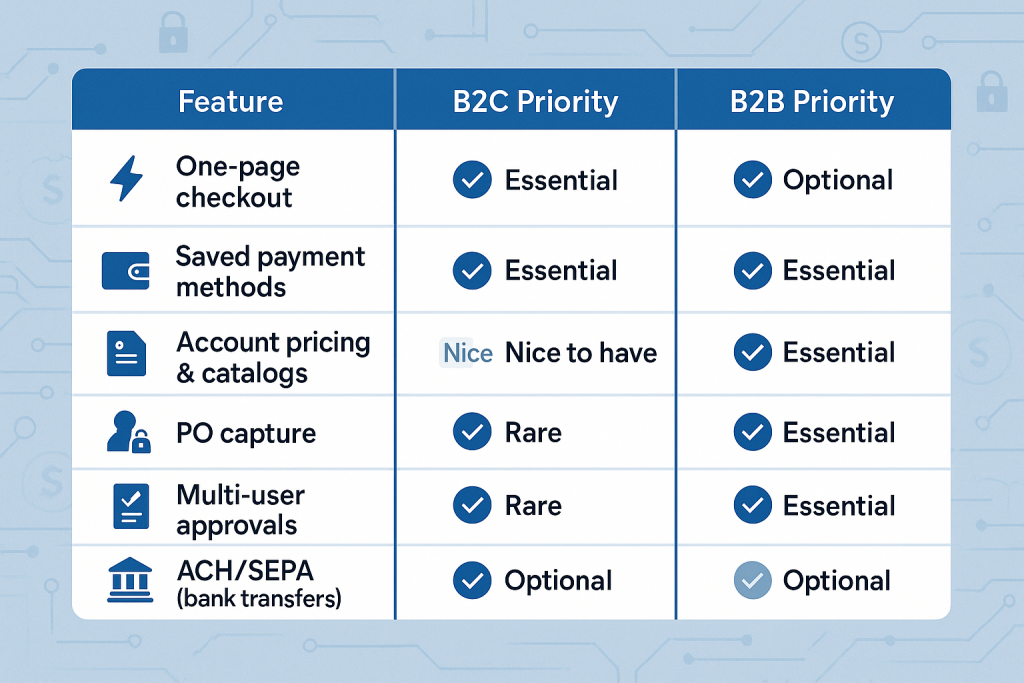

Feature matrix: what’s essential where

| Capability | B2C Priority | B2B Priority | Notes |

|---|---|---|---|

| One-page checkout & wallets | Essential | Optional | Useful for B2B reorders, but not a substitute for approvals |

| Saved payment methods | Essential | Essential | Use vaulted tokens; support corporate cards & bank accounts |

| Account pricing & catalogs | Nice to have | Essential | Contract pricing must appear before payment step |

| PO number capture | Rare | Essential | Must flow to ERP/AP and invoice |

| Multi-user roles & approvals | Rare | Essential | Admin, Buyer, Approver, Finance— with audit trail |

| Quotes → Order conversion | Rare | Essential | Convert negotiated quote to payable invoice |

| Net terms & credit limits | Rare | Essential | Auto-assign limits; block over-limit checkout gracefully |

| Partial/milestone payments | Rare | Common | Support deposits and progress billing |

| Bulk pay & remittance import | Rare | Essential | Match ACH/wire remittance to invoices automatically |

Security, compliance, and risk

B2C fraud tends to target stolen cards and account takeovers, so tools like device fingerprinting, 3DS/SCA, and behavioral analytics dominate.

B2B risk is more about invoice fraud, business email compromise, and bank detail tampering. Strong payee verification, dual control on bank account edits, and maker-checker approvals are critical.

Security checklist

- Enforce MFA for buyer admins and finance roles.

- Require dual approval for adding or changing payout/bank details.

- Use address, tax ID, and business verification before extending terms.

- Apply adaptive strong customer authentication for high-risk scenarios.

- Tokenize and vault payment data; keep card data out of your servers.

Fees, costs, and data

Card fees bite more on high-value B2B orders. Bank rails (ACH/SEPA) are cheaper, but slower. For card B2B, Level 2/3 data (line items, tax, shipping) can qualify for lower interchange on eligible commercial cards.

In B2C, conversion gains from wallets often outweigh minor fee differences.

Optimize costs by:

- Routing high tickets to ACH/SEPA with automated reconciliation.

- Sending Level 2/3 data on commercial card transactions.

- Using network tokens to lift approval rates and reduce retries.

- Negotiating blended vs. interchange++ pricing based on your method mix.

Taxes and invoicing

Consumers expect a receipt. Businesses need compliant invoices, sometimes e-invoices, and correct VAT handling (including exemptions or reverse charge where applicable).

Your checkout should validate tax IDs in real time, print the right tax on the invoice, and sync everything to ERP without manual edits.

Minimum viable invoicing for B2B

- Correct legal entity, tax ID, and billing address.

- PO number, line items, discounts, and terms.

- Delivery dates and tax treatment per line.

- Machine-readable invoice (PDF + data), posted to the buyer portal.

Cross-border considerations

B2C cross-border success comes from localizing price, currency, and wallets.

B2B adds bank formats (IBAN, ABA), cross-border wires, currency hedging, and compliance checks on counterparties. Display landed costs and tax handling upfront; do not hide them until invoicing.

Analytics and KPIs that matter

Track different dashboards for B2C vs B2B. Tie every metric to a lever you can pull.

B2C core KPIs

- Checkout conversion, wallet share, approval rate.

- Chargeback rate and recovery, refund % and reasons.

- Cost per successful transaction.

B2B core KPIs

- Time-to-approve order, % self-serve approvals.

- Days sales outstanding (DSO), on-time payment rate.

- Auto-reconciliation %, invoice dispute rate.

- Credit utilization and write-offs.

Implementation roadmap (choose your track)

If you’re primarily B2C

- Ship a one-page checkout with cards + top wallets; enable guest checkout.

- Add network tokens, card updater, and intelligent 3DS to lift approvals.

- Localize methods and currency for top markets; A/B test copy and field order.

- Monitor method-level drop-off and optimize routing rules.

If you’re primarily B2B (or a B2B marketplace/wholesaler)

- Model accounts: roles, approvals, contract pricing, and PO fields.

- Add net terms with automated credit checks and limits; expose terms at checkout.

- Offer ACH/SEPA, wires, corporate cards, and virtual cards; support remittance data.

- Integrate ERP/AP for invoices, credit notes, and reconciliation; support Level 2/3 for card savings.

- Implement payee verification and dual control for bank changes; audit everything.

Common mistakes to avoid

- Treating B2B like B2C.Forcing immediate card pay without POs, terms, or approvals pushes buyers offline.

- Treating B2C like B2B.Overcomplicating checkout destroys consumer conversion.

- Hiding fees or taxes until the end.Expect drop-offs and disputes.

- Manual reconciliation.At scale, it breaks finance ops and delays close.

- Weak change controls.Unverified bank edits are a prime fraud vector.

Summary table you can copy into a brief

| Decision Area | B2C default | B2B default | Owner |

|---|---|---|---|

| Primary methods | Cards + wallets | ACH/SEPA + cards + wires | Payments |

| Terms | Pay now | Net terms (N15/30/60) | Finance |

| Pricing | List/promo | Contract/tiered | Sales/RevOps |

| Approvals | None/1-click | Multi-user, role-based | Procurement |

| Invoicing | Receipt | Invoice + PO + credit notes | Finance |

| Reconciliation | Per order | Remittance & auto-match | Accounting |

| Fraud focus | Stolen cards/ATO | Invoice fraud/BEC | Risk/SecOps |

Final takeaway

If you sell to consumers, obsess over speed and acceptance. If you sell to businesses, obsess over accuracy, approvals, and cash-flow control. When in doubt, design your payment flow around how your buyer actually buys—not how your gateway wants to process a card.