How Electronic Verification of Companies via Government Registers Works in Scandinavia

August 6, 2025

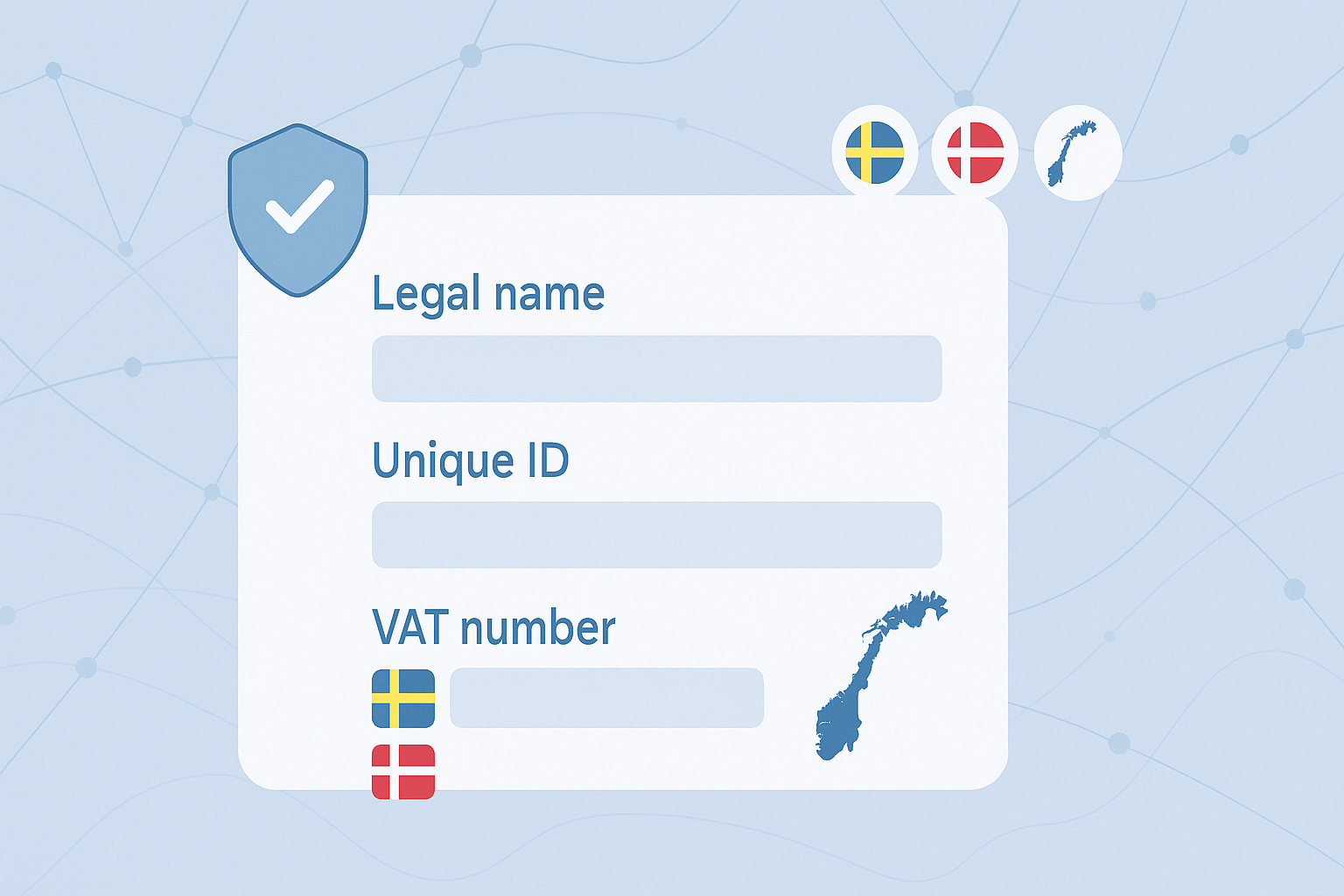

Electronic verification lets you confirm a company’s legal identity, status, ownership, and signing rights directly from official registers. In Scandinavia, the process is mature, API-friendly, and designed for compliance teams who need fast, audit-ready checks. This guide breaks down how it works in Sweden, Denmark, and Norway, what to query, and how to turn results into decisions.

Who this is for. Compliance leads, fintechs, marketplaces, and B2B platforms that onboard Scandinavian companies and must meet KYC/AML and fraud-prevention standards. You’ll get a practical, implementation-ready playbook.

Bottom line. You verify a company by pulling its core record from the national business register, validating VAT where needed, retrieving beneficial owners, and confirming who can legally sign. Then you cross-check and log everything for audit purposes.

At a glance: where you actually look up a company

In practice, 90% of your verification comes from the three national registers below. Use them as your “source of truth,” then layer VAT and UBO checks.

| Country | Primary register (operator) | Unique ID | Public search / API | UBO register | VAT rule / proof |

|---|---|---|---|---|---|

| Sweden | Swedish Companies Registration Office — Bolagsverket | Organisationsnummer | Public “Find company information”; various e-services | Register of beneficial owners (Verklig huvudman) | VAT verified through Skatteverket and EU VIES for intra-EU trade |

| Denmark | Central Business Register (CVR) — Danish Business Authority | CVR number (incl. P-numbers for units) | CVR search; official CVR APIs via Datafordeler | Beneficial owners are part of CVR (Ejerregisteret) | Standard EU VAT validation via VIES |

| Norway | Brønnøysund Register Centre — Enhetsregisteret / Register of Business Enterprises | Organisation number | Public search + open Enhetsregisteret API | Register of Beneficial Owners (registration mandatory; full roll-out 2024–2025) | VAT number is organisation number + “MVA” |

The table above reflects official functions and current access models provided by each authority. Denmark exposes CVR data via official endpoints; Norway offers open API docs; Sweden provides public search and paid documents through Bolagsverket. For VAT, use the EU’s VIES tool for cross-border validation.

What “electronic verification” means in practice

You confirm that a company exists, is active, and is who it says it is by matching fields from the business register to the data the company provides. You also check VAT validity for cross-border transactions and identify ultimate beneficial owners. Finally, you confirm signatory rights so you know who can legally sign contracts or consent on behalf of the company.

Step-by-step workflow you can implement today

- Collect inputs. Ask for legal name, unique ID (organisationsnummer/CVR/organisation number), registered address, and VAT number if relevant.

- Query the business register. Pull the company profile via public search or API where available (CVR/Datafordeler; Enhetsregisteret API; Bolagsverket search). Normalize names, addresses, and legal forms.

- Check status and dates. Confirm the entity is active, review incorporation date, and note any dissolution or bankruptcy flags.

- Validate VAT. For intra-EU trade, confirm VAT with VIES; for Norway, remember the VAT ID equals the organisation number + “MVA” when registered.

- Retrieve UBOs. Pull or purchase UBO info where applicable (Bolagsverket); in Denmark use the CVR/Ejerregisteret view; in Norway, use the new Beneficial Owners Register as it phases in.

- Confirm signatory rights. Identify who can bind the company (signatory/authorization roles). Many verification providers expose this from Bolagsverket; Denmark and Norway reflect signing rules in their registers and e-ID portals.

- Cross-check and score. Compare declared vs. official data, apply fuzzy matching on names, and flag discrepancies for manual review.

- Log evidence. Store raw responses, timestamps, request IDs, and screenshots/docs for audit trails.

Data points you should match on every check

- Legal name and unique ID match (spelling, spacing, special characters).

- Legal form and current status (active/dissolved/in liquidation).

- Registered address and country.

- VAT validity and country format rules.

- Signatory/authorization roles for e-signature flows.

- UBOs and control paths (direct/indirect).

- Any sanctions or PEP hits via your screening tools.

Electronic IDs and digital signing: who can sign, and how

Scandinavian registers pair well with national e-IDs that prove a human is authorized to act for the company. In Denmark, MitID (incl. MitID Erhverv) governs business logins and employee signatures to public services. In Sweden, e-identification such as BankID is required for many Bolagsverket e-services. In Norway, ID-porten supports BankID, MinID, Buypass, and Commfides for logging into services like Altinn.

What’s unique in each country (practical notes)

- Sweden.Use Bolagsverket’s “Find company information” to confirm current basics, then purchase documents or UBO data as needed. Signatory rights are commonly exposed via service providers who normalize Bolagsverket data.

- Denmark.CVR is your master record; production units (P-numbers) matter for site-level operations. Official CVR APIs are available via Datafordeler for programmatic checks; UBO data is integrated in CVR.

- Norway.The organisation number is the anchor key across registers and doubles as the VAT number when “MVA” is appended for VAT-registered entities. Norway’s Beneficial Owners Register opened for registration in October 2024 with compliance deadlines in 2025.

Quality guardrails and edge cases

UBO data can lag when ownership changes frequently or spans multiple jurisdictions. Sweden’s supervision framework has been asked to strengthen verification to ensure completeness and timely updates. Norway’s new UBO regime has a phase-in period; ensure your logic accommodates “no data yet” during roll-out. Denmark’s CVR is broad, but foreign ownership chains can still require manual evidence. Build exception handling for all three.

Implementation patterns that save time

- Normalize early.Standardize name, ID, and address formats on ingestion to cut false mismatches.

- Cache with TTL.Cache register lookups for 24–48 hours; re-check on critical events (payouts, large invoices, new contracts).

- Keep raw + cooked data.Store both the original JSON/HTML and your normalized fields to pass audits.

- Separate confidence from compliance.Use a matching score to drive UX, but gate final approval on mandatory flags (e.g., active status, signatory verified, VAT valid, UBO present).

Compliance checklist (copy/paste into your SOP)

- Company exists and is active in the national register.

- Unique ID matches exactly; address and legal form match.

- VAT validated (VIES or national rule, e.g., “MVA” in Norway).

- UBOs retrieved and stored; unresolved ownership escalated.

- Signatory rights confirmed before any e-signature.

- All evidence logged with timestamps and request IDs.

Wrap-up

Electronic verification in Scandinavia is straightforward when you anchor to the national business registers and layer VAT, UBO, and signatory checks. Build a short, automated pipeline, keep clean logs, and you’ll satisfy regulators while keeping onboarding fast.