Baby market in Europe: What Awaits in the Next Decade

September 1, 2025

By 2035, a range of forces is set to shape the baby products market in Europe: growing parental awareness of child protection and eco-friendliness, technological innovation, shifting consumer values, and stricter EU regulations. Demand is moving toward responsible consumption, with a strong focus on sustainable baby product manufacturing, digital solutions, and product personalization.

Below, we explore the main trends, growth forecasts, and challenges that manufacturers and suppliers are likely to face in the next ten years.

Market Overview

Let’s see how Europe’s baby products market is organised, which segments are growing the fastest, and who leads the way.

Size and Growth Rate

The European Baby Care Products Market report estimates that the baby products market size will reach $31.606 billion in 2025 and rise to $36.113 billion by 2030, reflecting a compound annual growth rate (CAGR) of 2.7%.Care and hygiene products, together with infant nutrition, account for the largest share of the market. Clothing, playthings, and furniture account for a smaller baby products market share.

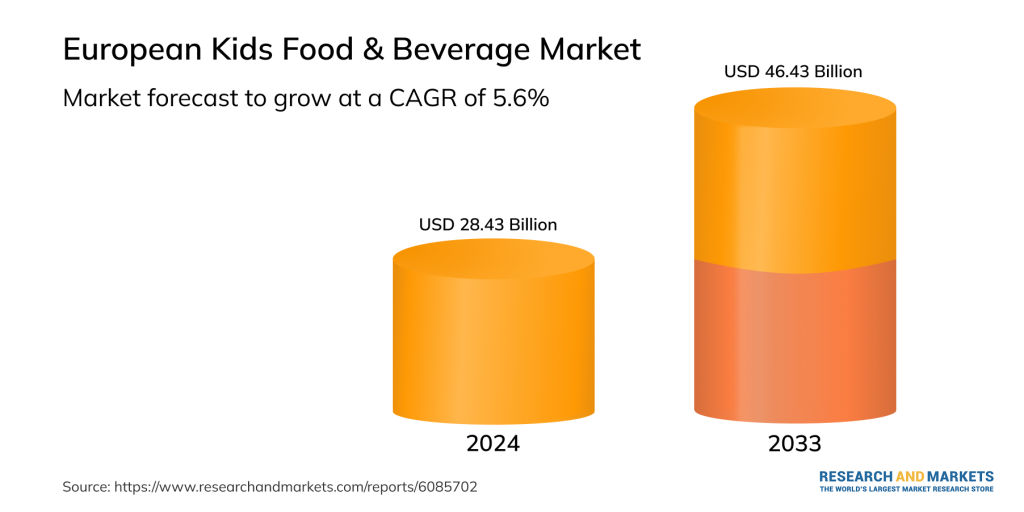

Research and Markets figures show the infant food and drink segment across Europe is growing faster than other categories. In 2024, its value stood at $28.43 billion, with forecasts pointing to $46.43 billion by 2033, reflecting an average annual growth rate of 5.6%.

The upward trend is fuelled by increasing interest in organic and minimally processed goods, which parents see as a more secure and beneficial option for their kids.

Wholesale Development

According to TechSci Research,the baby products wholesale sector continues to show steady growth. E-commerce platforms are broadening their assortments, implementing omnichannel approaches, and providing favourable cooperation conditions for suppliers.

This model allows swift responses to shifting buyer needs, supports the acquisition of new partners, and meets the expectations of caregivers who appreciate convenient ordering, prompt shipping, and dependable item standards.

Market Leaders

In Sweden and Denmark, both global corporations and domestic brands operate side by side.Among international companies with significant influence are:

- Chicco

- Philips Avent

- Beiersdorf

- Kimberly-Clark

- Unilever

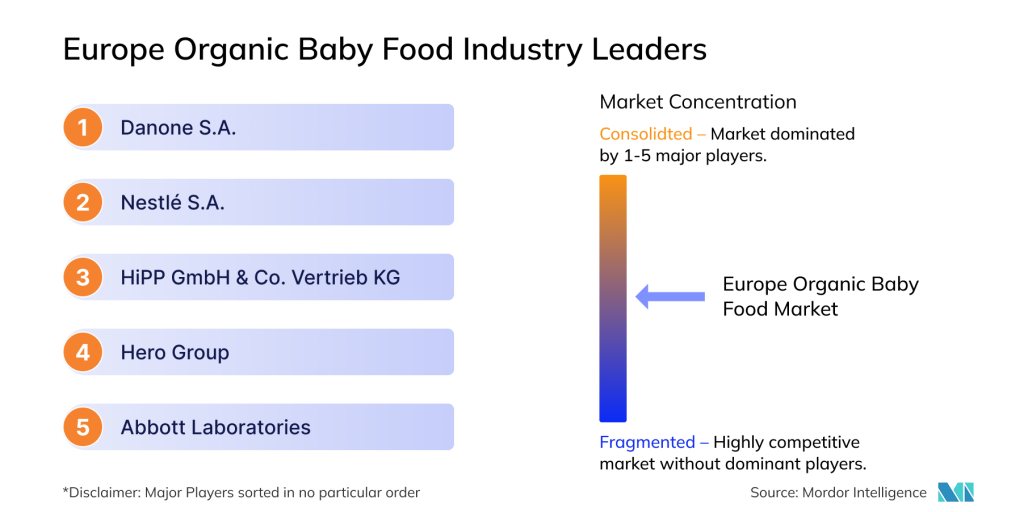

Within the organic infant nutrition sector, Mordor Intelligence names Danone S.A., Nestlé S.A., HiPP GmbH & Co. Vertrieb KG, Hero Group, and Abbott Laboratories as leading players.These companies set key trends, establish quality standards, and invest in developing new products.

Alongside these leaders, regional brands — including private label baby products manufacturers — are actively competing. Their advantages lie in flexible pricing, deep understanding of local needs, and rapid introduction of new products.

Baby market growth in Europe is uneven: some categories expand steadily, while others see rapid surges driven by evolving consumer preferences and tougher regulations.

Key Baby Industry Trends

This sector quickly adapts to shifts in caregivers’ lifestyles and technological advances. Several major trends are already shaping supply and buyer interest today and are set to influence the sector in the years ahead.

- Safety and Sustainability. Interest in eco-friendly baby products is steadily rising. According to GlobeNewswire, an increasing number of parents are steering clear of ultra-processed meals, artificial flavourings, and synthetic substances. This applies not only to baby care products but also to organic baby clothes, biodegradable wrapping, and non-toxic furniture.

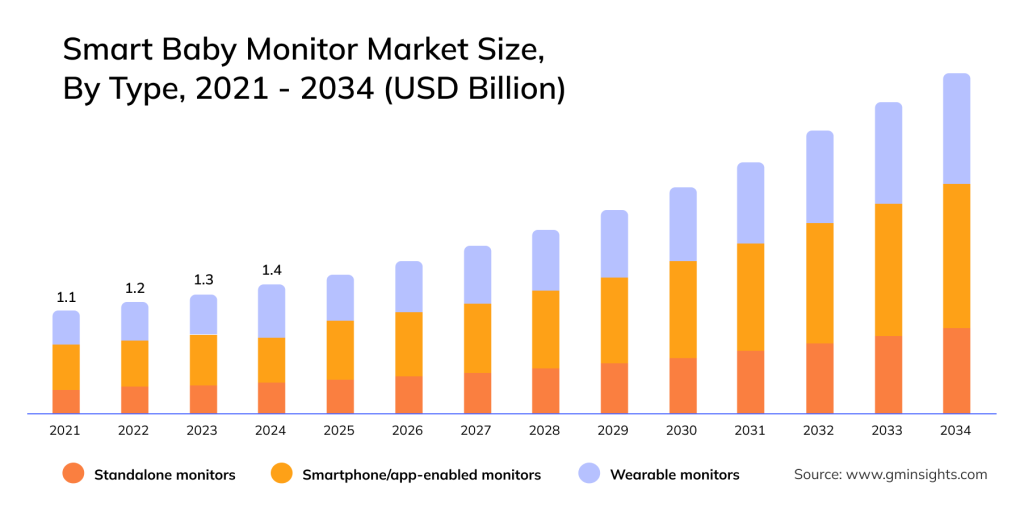

- Technology and Advancement.Baby product innovationfocuses on ensuring childcare is easier and more secure. Demand is rising for thermometers, electronic swings, and mobile apps for tracking sleep, wellbeing, and nutrition. Smart baby monitors are gaining particular popularity. Global Market Insights projects that the worldwide market for these devices will grow from $1.4 billion in 2024 to $3.7 billion by 2034, reflecting an annual growth rate of about 10.3%.

The fastest growth is expected among devices that can connect to mobile apps, as well as wearable models that attach directly to a child’s clothing or body. These stand out for their compact size, ease of use, and ability to integrate with other digital services.

- Item Personalization. Interest in personalized baby gifts remains strong in both the mass and premium segments. Examples include name-embroidered blankets, customised tableware, books, and newborn gift sets with unique designs. Such products are well-suited for online stores and boutique offerings, as they fit various budgets and can be readily tailored to customer preferences.

Together, these trends are set to shape the baby products market over the next few years, generating fresh prospects for those who are prepared to adapt quickly.

Regulatory Changes and the Impact on Manufacturers and Suppliers

Until 2025, the safety of toys in the EU was governed by Directive 2009/48/EC, which set requirements for physical, chemical, electrical, and hygiene characteristics, as well as mandatory EN71 compliance.

In 2025, Europe adopted the updated EU Toy Safety Regulation, replacing the previous directive. The new rules are considerably stricter and address modern risks while incorporating digital tools. Below, we highlight the key updates that will affect the manufacturing and sale of children’s products across Europe.

Digital Product Passport

Every children’s item must now have a digital product passport in the form of a QR code. It allows buyers to instantly verify an item’s origin, check for the presence or absence of hazardous substances, and confirm CE certification compliance adherence along with other safety standards.

Ban on Hazardous Substances

The regulation prohibits all substances that may disrupt the endocrine system, including PFAS and the most harmful types of bisphenols.

Manufacturers and suppliers must not only meet these updated standards but also respond to growing parental expectations. Before making a purchase, many parents actively research information, often consulting baby industry reports and independent reviews.

Business Recommendations for Product and Strategy Adaptation

To succeed in the European baby products market in the coming decade, businesses must account for regulatory changes and respond quickly to shifting buyer preferences.

Below are the main areas manufacturers and suppliers should prioritise:

- Adapting ranges to environmentally friendly products. Replace synthetic materials with organic fabrics and bioplastics, and opt for paper or biodegradable packaging. Highlight environmental benefits in item descriptions to attract parents seeking eco-friendly options.

- Investing in innovation. Develop or integrate smart devices like baby monitors and digital swings. Add mobile apps with features for tracking sleep, wellbeing, and nutrition, using AI to provide personalised parenting tips.

- Meeting CE certification and EN71 standards. Conduct item testing in recognised EU laboratories such as RISE Research Institutes of Sweden and Force Technology, along with international centres like TÜV Rheinland, Intertek, or SGS, which have offices and partner labs in Scandinavia. Secure all required certifications and clearly indicate compliance with baby product safety standards on the label.

- Transparency and digital product footprint. Include a QR code on the packaging that links to detailed information on composition, certifications, country of origin, and environmental impact. Ensure the information is available in multiple languages.

- Logistics and supply chain optimization. Partner with reliable logistics providers, reduce delivery times, and improve inventory management. Implement real-time product tracking for partners.

- Product personalization. Offer name engraving, custom designs for clothing, accessories, and toys, or curated gift sets. Add an online configurator to your website so customers can create their own orders.

Following these recommendations will help businesses strengthen their market position, build consumer trust, and drive long-term sales growth.

Conclusion

By 2035, the baby market in Europe will have shifted decisively online, with marketplaces becoming the primary sales channel. For manufacturers and suppliers, this will provide faster market entry, access to a wider audience, and the ability to scale without significant investment in their own infrastructure.

The strongest demand will be for safe, eco-friendly, and personalised products that easily find their buyers online. ServiCom can help you make the most of these trends: list your products on the platform, connect with customers quickly, and operate securely alongside verified partners.